All Oregonians need a safe, stable and affordable place to call home. Right now, Oregon’s renters are struggling to keep up as rents outpace income, pushing homes that they can afford out of reach.

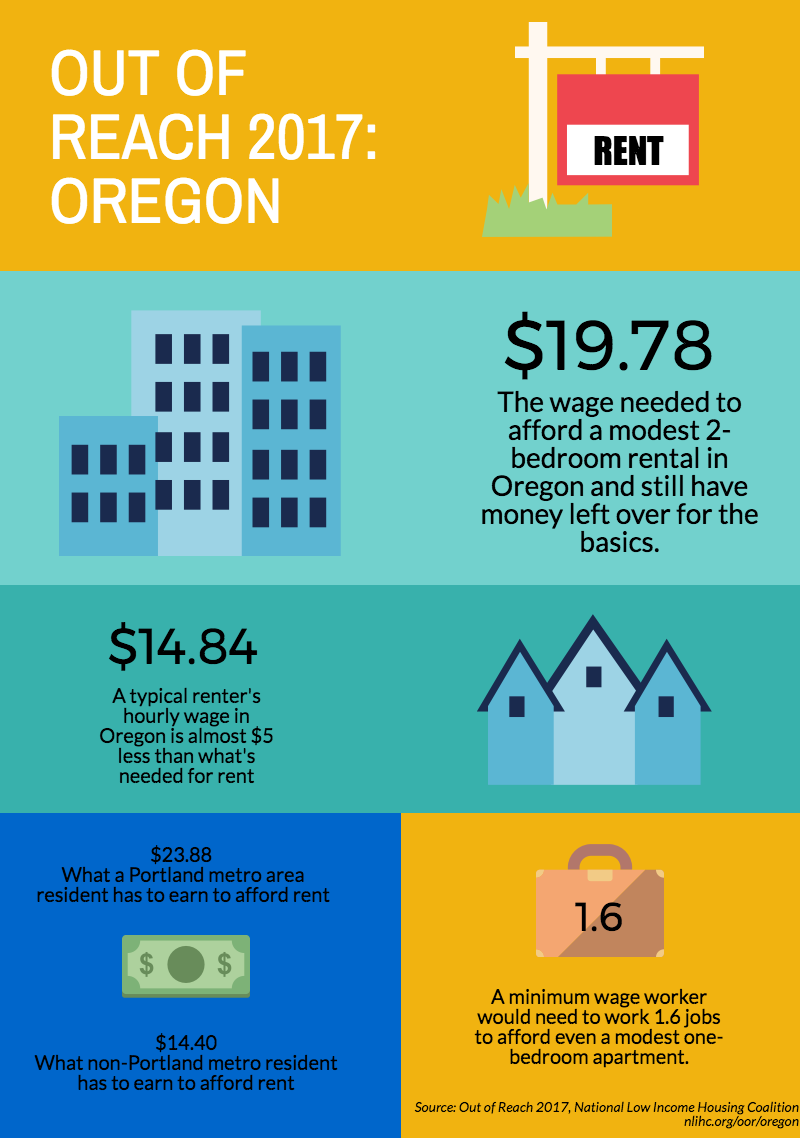

According to the Out of Reach 2017 report released today by the National Low Income Housing Coalition, renters in Oregon need to earn $19.78 per hour to comfortably afford a modest, two-bedroom apartment. Combined with a huge number of no-cause evictions, dramatic rent increases, very low vacancy rates, and climbing home prices, the 4 in 10 Oregonians who rent their homes are facing serious barriers to housing stability. Rents have risen 27 percent in just five years, from $807 in 2012 to $1,028 in 2017, while wages have not kept pace. The Oregon Legislature needs to act now to protect renters in this overheated housing market and to invest in affordable housing.

Out of Reach 2017 shows that Oregon is the 18th most expensive state for renters. The report highlights that in no county in Oregon can a renter earning minimum wage and afford a safe place to call home without spending too much of their income on rent.

Key figures from the report illustrate the growing challenges facing Oregon’s renters:

- In order to afford a modest, two-bedroom apartment at Fair Market Rent in Oregon, renters need to earn a “Housing Wage” of $19.78 per hour.

- The typical renter in Oregon earns $14.84 an hour, which is almost $5 less than the hourly wage needed to afford a modest two-bedroom home.

- In the Portland metro area, a renter has to earn $23.88 an hour to be able to afford the average two-bedroom apartment and still have money left over for food, medicine, transportation, and other basic necessities.

- Outside of the Portland metro area, renters must earn $14.40 an hour to be able to afford the average two-bedroom apartment.

- After the Portland metro area, the Corvallis, Eugene-Springfield, and Albany metropolitan statistical areas along with Hood River County have the highest housing costs.

- There is no county in the state with a fair market rent that is affordable for a worker employed full-time at minimum wage. A family must have 1.6 wage minimum wage earners working full-time, or one full-time earner working 63 hours per week—that’s 9 hours a day, every single day of the week—to afford even a modest one-bedroom apartment.

These numbers indicate that the Oregon Legislature cannot wait to take action on housing. The Legislature must prioritize putting housing opportunity within reach of every resident. Top of Form Tools like emergency rent assistance can help keep families in their homes as rents rise. Funds to create more affordable housing, preserve the affordable homes we already have, and increase homeownership opportunities are all critical solutions to out of reach rents. Find your legislators here and tell them to take action for housing this session.

For more information on wages and housing affordability in Oregon, see the full Out of Reach national report and the state report for Oregon, and be sure to subscribe to Housing Alliance emails to stay up to date on help ensure every Oregonian Oregonian can afford a decent, stable home.